A Comprehensive Overview to How Credit Scores Fixing Can Change Your Credit History

Comprehending the complexities of credit repair service is important for any individual seeking to enhance their financial standing - Credit Repair. By attending to issues such as repayment background and debt use, individuals can take positive steps toward boosting their credit rating. The procedure is commonly fraught with misconceptions and possible challenges that can hinder development. This overview will light up the key strategies and considerations necessary for successful credit score fixing, ultimately revealing just how these efforts can lead to much more positive economic possibilities. What continues to be to be explored are the particular actions that can set one on the path to a much more durable credit report account.

Comprehending Credit Rating

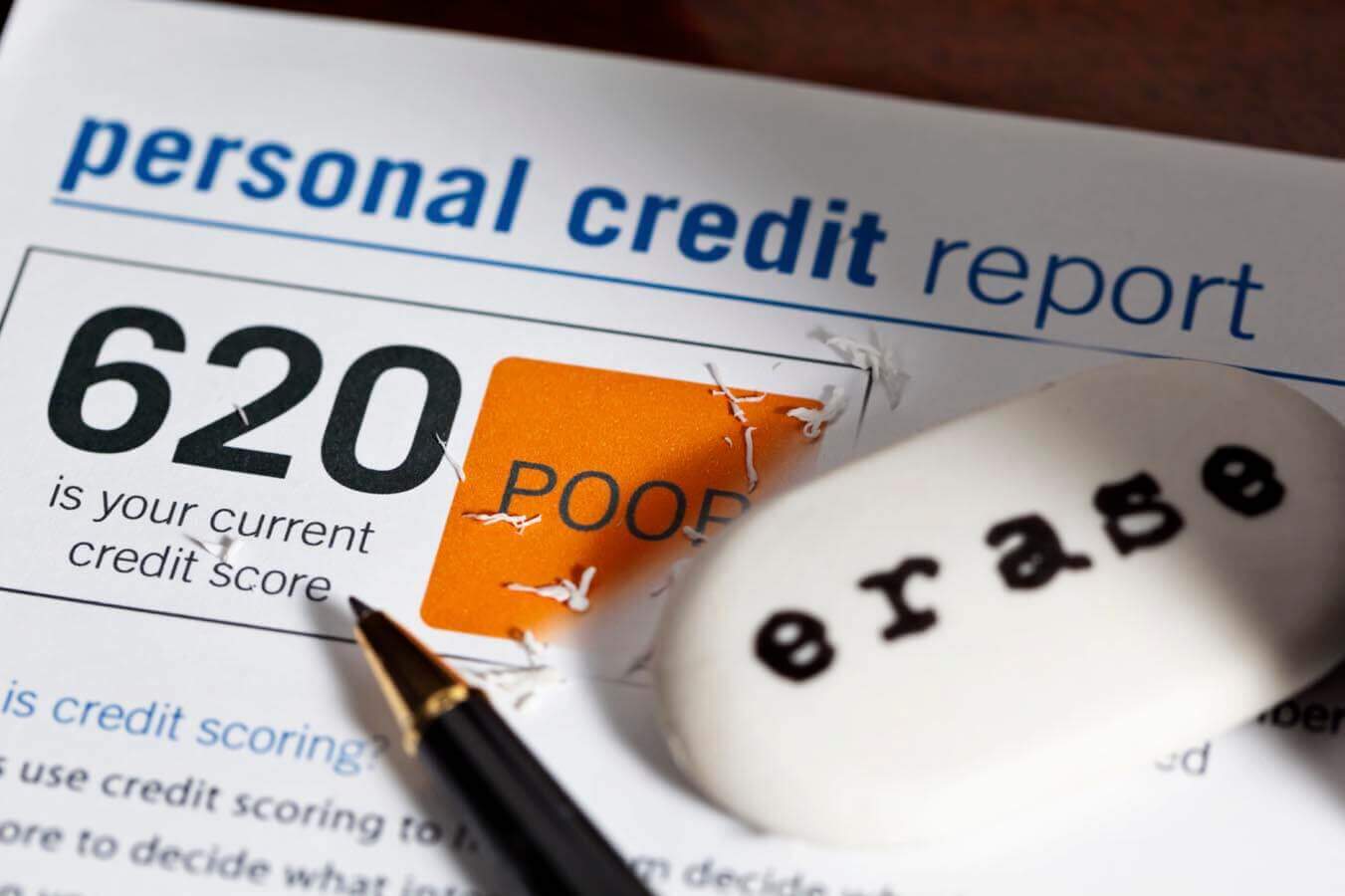

Understanding credit report is crucial for any individual seeking to enhance their financial health and accessibility much better borrowing choices. A credit rating is a mathematical depiction of an individual's creditworthiness, generally varying from 300 to 850. This score is produced based on the details included in an individual's credit history report, which includes their credit report, superior financial debts, repayment background, and kinds of charge account.

Lenders make use of credit score ratings to evaluate the threat connected with providing money or extending credit scores. Greater ratings indicate lower threat, often causing extra beneficial finance terms, such as reduced rates of interest and higher credit line. Conversely, lower credit rating can cause greater rate of interest or denial of credit report altogether.

A number of variables affect credit report, including payment background, which makes up about 35% of the rating, adhered to by credit history use (30%), length of credit report (15%), sorts of credit rating in operation (10%), and new credit rating queries (10%) Recognizing these aspects can equip individuals to take workable actions to enhance their scores, ultimately enhancing their financial opportunities and stability. Credit Repair.

Typical Credit Report Issues

Several individuals deal with typical credit score problems that can hinder their financial progression and impact their credit rating. One widespread concern is late repayments, which can considerably damage credit ratings. Also a single late settlement can continue to be on a credit record for a number of years, influencing future loaning potential.

Identity theft is an additional significant worry, potentially leading to illegal accounts showing up on one's credit record. Attending to these typical credit report problems is necessary to enhancing financial wellness and establishing a strong debt account.

The Credit Score Repair Service Refine

Although credit scores repair work can appear challenging, it is a systematic procedure that individuals can take on to enhance their credit report and correct errors on their credit records. The very first step includes obtaining a duplicate of your credit history report from the three significant credit report bureaus: Experian, TransUnion, and Equifax. Review these reports meticulously for disparities or errors, such as inaccurate account information or outdated info.

Once errors are determined, the next action is to challenge these errors. This can be done by calling the debt bureaus directly, supplying documentation that supports your insurance claim. The bureaus are called for to examine disagreements within thirty days.

Preserving a regular settlement background and taking care of credit score application is also critical during this process. Checking your credit history consistently ensures recurring precision and assists track improvements over time, reinforcing the performance of your debt repair initiatives. Credit Repair.

Advantages of Credit Report Repair Work

The benefits of credit rating fixing expand much beyond simply enhancing one's credit report; they can considerably impact financial security and opportunities. By resolving mistakes and negative things on a credit history report, individuals can improve their creditworthiness, making them extra appealing to lenders and banks. This improvement usually brings about better rate of interest on car loans, reduced premiums for insurance policy, and enhanced opportunities of approval for credit rating cards and home mortgages.

Moreover, credit score repair can assist in accessibility to important solutions that require a credit check, such as leasing a home or acquiring an utility solution. With a much healthier credit score profile, people might experience enhanced confidence in their financial decisions, enabling them to make bigger acquisitions or investments that were previously out of reach.

Along with substantial financial benefits, credit repair work promotes a sense of empowerment. Individuals take control of their financial future by proactively handling their credit history, leading to more educated options and better economic proficiency. On the whole, the advantages of credit history repair work add to a much more steady economic landscape, inevitably advertising long-lasting financial development and personal success.

Selecting a Credit History Repair Work Solution

Selecting a credit fixing solution calls for cautious consideration to ensure that individuals obtain the assistance they need to enhance their economic standing. Begin by investigating possible companies, concentrating on those with positive client testimonials and a tested record of success. Openness is crucial; a reputable service ought to plainly detail their fees, procedures, and timelines ahead of time.

Next, verify try this that the credit scores repair solution adhere to the Credit rating Fixing Organizations Act (CROA) This federal law shields consumers from deceptive techniques and sets standards for credit report repair work solutions. Prevent companies that make unrealistic promises, such as ensuring a specific rating increase or declaring they can remove all unfavorable things from your record.

Additionally, take into consideration the level of consumer support used. A good debt repair work service must give individualized aid, allowing you to ask concerns and obtain timely updates on your progression. Try to find solutions that offer a detailed evaluation of your credit report and create a tailored approach tailored to your particular circumstance.

Inevitably, choosing the best credit scores repair work service can result in considerable renovations in your credit report, encouraging you to take control of your economic future.

Final Thought

Finally, reliable credit report repair service approaches can considerably enhance credit rating by resolving usual concerns such as late settlements and errors. A detailed understanding of credit rating elements, integrated with the engagement of respectable credit report repair service solutions, helps with the settlement of unfavorable products and ongoing progress surveillance. Inevitably, the effective enhancement of credit rating not only brings about far better lending terms but additionally cultivates higher financial opportunities and security, highlighting the significance of proactive credit rating monitoring.

By attending to issues such as repayment click here for more history and credit use, individuals can take aggressive steps towards improving their debt ratings.Lenders utilize credit rating ratings to evaluate the threat connected with lending money or prolonging credit report.Another regular trouble is high credit report usage, specified as the ratio of present credit report card balances to overall readily available credit report.Although credit scores fixing can seem overwhelming, it is a methodical process that individuals can take on to improve their credit score ratings and correct errors on their credit scores reports.Following, confirm that the credit report repair solution complies with the Credit rating Repair Work Organizations Act (CROA)